January 06, 2026

Marc Rothmeye

Why Generative AI Is Reshaping Financial Services

Mobcoder’s Approach of Generative AI Development Services in Finance Sector

Where We See the Most Impact Today

AI Use Cases Across Financial Services

Responsible AI Is Not Optional - It’s a Necessity

Looking Ahead

Generative AI has moved from the experimentation stage to the expectation stage in the financial services sector. What was once considered a future-facing innovation is now shaping how banks, insurers, fintechs, and investment firms operate, compete, and grow.

According to the World Economic Forum’s Artificial Intelligence in Financial Services for 2025 report, financial institutions are uniquely positioned to benefit from AI because of their data-rich, language-heavy operations and functioning. At the same time, the pace of change, regulatory pressure, and rising risk make responsible deployment more critical than ever.

At Mobcoder, we help financial services organizations move beyond pilots and proofs of concept: toward scalable, secure, and business-aligned Generative AI systems. Through this blog, we’ll share how we approach AI deployment, grounded in industry realities and informed by global research.

Financial services is one of the industries that has been an early adopter of automation and analytics. Generative AI or GenAI accelerates this trajectory by enabling systems that can understand language, synthesize information, and take contextual action.

The WEF report further highlights how BFSI sector can benefit from advanced technology:

What’s changing now is where the value is coming from. Early AI efforts focused on efficiency and cost reduction. Today, businesses are shifting toward:

As a leading Generative AI Development company, Mobcoder’s strategy reflects this shift from backend optimization to end-to-end transformation.

We don’t just start with model building. We start with understanding context.

Financial services operate in one of the most regulated, risk-sensitive environments. Our Gen AI deployment strategy is designed to balance innovation, compliance, and trust in this highly regulated industry. Our simple yet effective plan of action include:

Many organizations feel overwhelmed when they first come to know about the AI possibilities. Experts at Mobcoder helps clients simplify AI and prioritize use cases that:

Common starting points in a financial company include:

This mirrors a key insight, which is also supported in the report: early success builds confidence and unlocks long-term investment.

The dependability for Generative AI models will be only as good as the data on which the model is based. The quality and privacy of data are non-negotiable in the finance industry.

We assist businesses in the process to:

We often use the architecture of “retrieval augmented generation” or RAG, where the system can generate answers based on approved internal documentation, like policies, procedures, or product information, instead of using general knowledge of the model.

It increases accuracy, explainability, and regulatory compliance.

Not every problem needs a large, general-purpose model.

Inspired by trends, which are also outlined in the WEF paper, Mobcoder increasingly works with:

This allows financial institutions to move faster while maintaining reliability and cost efficiency.

One of the most transformative shifts highlighted in the report is the rise of AI agents in banking: systems that don’t just respond, but act.

Mobcoder designs agentic AI systems that can:

In financial services, this is done with guardrails:

The result is faster service and smarter operations, without sacrificing control.

AI delivers value only when it fits into real workflows.

Mobcoder integrates Generative AI development services into:

This enables real-time insights, consistent experiences, and seamless adoption by teams, rather than standalone tools that never get used.

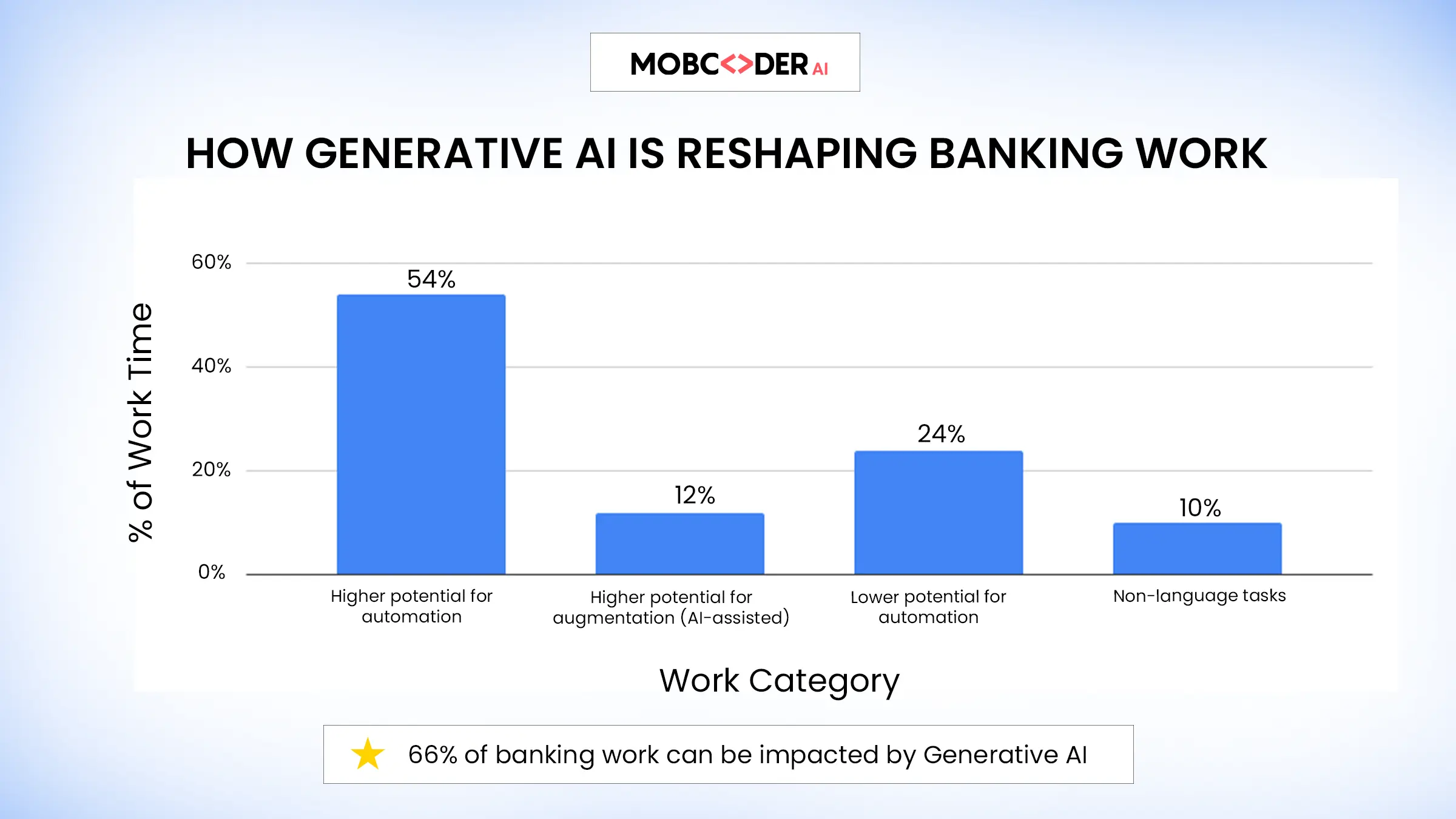

Source: Accenture (2023) A new era of generative AI for everyone

Drawing from both the WEF findings and our client work, we see Generative AI creating strong impact in:

These are not theoretical benefits, they are practical improvements that compound over time.

| Industry | Function | How AI Is Used | Value Delivered |

|---|---|---|---|

| Banking | Sales & Service | Helps agents quickly find accurate product and policy information | Faster responses, better accuracy, higher productivity |

| Capital Markets | Client Servicing & Investments | Provides real-time insights and personalized portfolios | Improved client satisfaction, better decisions |

| Payments | Fraud Detection | Identifies suspicious activity before fraud occurs | Stronger fraud protection, fewer false alerts |

| Insurance | Claims Processing | Automates claims handling and document review | Faster claims, reduced manual work |

| Across Financial Services | Risk & Underwriting | Improves risk scoring and fraud prediction | Lower risk, faster approvals |

| Technology | Software Development | Speeds up coding, testing, and system modernization | Shorter cycles, better code quality |

The WEF report is clear: misinformation, deepfakes, data privacy, and bias are among the most significant risks facing financial services.

Mobcoder is one of the top Generative AI companies that treats responsible AI as a core design principle in every project we do and not leave it as an afterthought. Our deployments include:

This allows organizations to innovate with confidence, even as regulatory landscapes continue to evolve.

The financial industry is being disrupted by generative AI at a pace that has been driven by no other innovation in the past. The institutions will grow that proceed with a deliberate approach in AI development, striking a balance between ambition and discipline.

As a relevant Generative AI development company, Mobcoder assists the financial industry in:

The future of the financial services industry is going to be AI-driven, and this future is going to be built by those who are experts in this.

Speak to our experts, and receive a blueprint on creating a sustainable and AI-friendly financial business.

Girijesh Kumar

February 18, 2026

10min

Marc Rothmeye

February 03, 2026

8min

Girijesh Kumar

January 27, 2026

9min