December 22, 2025

Girijesh Kumar

Do AI Agents in Banking Work Just Like Chatbots?

The Competitive Advantage of Using AI Agents in Banking Sector

Best Use Cases of AI Agents in Banks

Become AI-First Banking with Agentic AI Development Company

FAQs

In the pursuit of customer-centric banking, the industry is quickly embracing a new wave of innovation through Artificial Intelligence called AI agents. AI agents in banking are not like regular bots, who just answer user queries, these agents act as autonomy, take in new information and then execute multi-step tasks.

Let’s explore the impact of AI agents in banking,and how it helps streamline manual operations to increase customer engagement.

If someone from the BFSI (Banking, Financial Services and Insurance) is reading this blog, be prepared to know how AI agents can smartly automate processes, for you to focus on more important things.

No. Both are far different.

Chatbots are for simple Q&As with pre-filled answers, whereas AI agents are like an autonomous system capable of reasoning, planning, and taking actions to achieve goals.

For example, a user interacting with a chatbot will only respond with the information that has already been provided. But an AI agent using conversational AI techniques to understand Natural Language Processing (NLP) will act on the query. It can guide the user with the best way possible to take the right action.

In the banking industry, this translates to reduced manual processing, shorter response times, and easier outcomes. These chatbots don’t just serve the employees within the company, they work alone to maximize efficiency and provide smart automation where it really matters.

Also Read - From Concept to Creation : The Power of Generative AI in Modern Product Development

Agentic AI in banking can take care of the everyday office tasks, while also doing customer service. Compared to traditional banking, using AI agents can help automate, scale a business and drive measurable growth.

Banks are increasingly embracing the use of intelligent automation technology due to the fast-paced developments in generative AI technology and machine learning. For instance, the use of AI technology enables banks to automate processes such as:

In contrast to rule-based automation, AI agents possess the ability to understand context, make decisions, and adapt their behavior on their own without continued human control. For banks, it becomes possible to accomplish their operation goals effectively and inexpensively, faster, and at scale, while leaving their human resources to perform more valued tasks, such as relationship building, risk monitoring, or decision-making.

Multi-agent systems are generally better than single-agent systems, since in a multi-agent situation, agents can work together, specialize in their tasks, and also examine a different course of action at the same time. These qualities are particularly valuable in a bank environment, where timely results, correctness, and risk reduction are a priority.

For instance, one agent could deal with estimating credit risk, another with identifying fraudulent activities, and a third with ensuring regulatory compliance.

Such AI agents are capable of furnishing much more comprehensive and personalized results as opposed to traditional models of AI and have the ability to significantly improve the experience of both consumers and employees associated with banking services.

This implies that customers will enjoy quicker problem-solving, personalized financial tips, and consistency in services. Bank employees will benefit through improved insights, decision-making support, and easing the cognitive burden.

Also Read - What Is Conversational AI? How It’s Changing the Way We Communicate

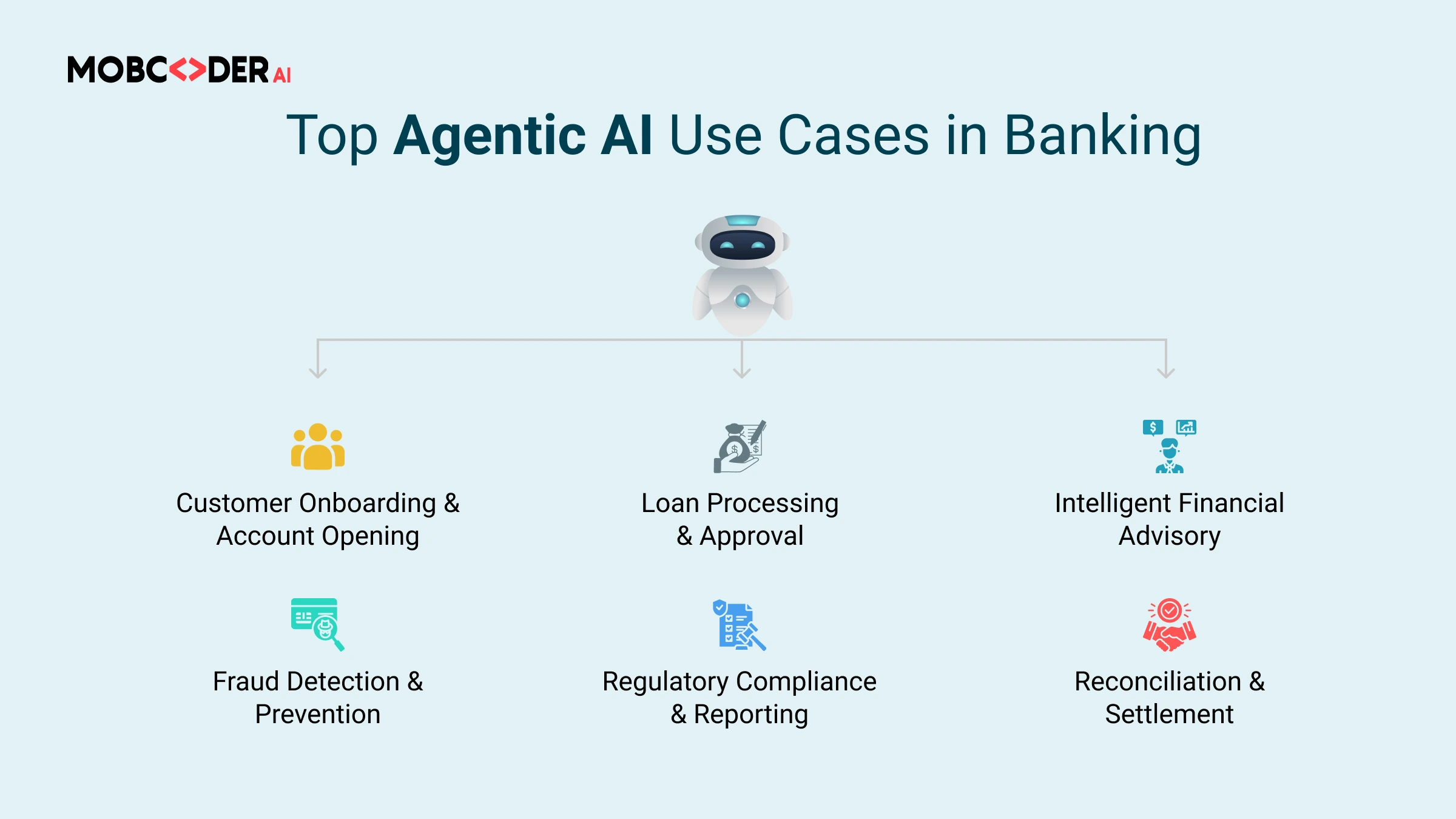

AI agents can be utilized in various banking operations, including customer service. Some of the top use cases can help you understand the functioning of AI agents:

Customer onboarding and new account opening is done by fetching customer details, identity verification through KYC and setting up documentation approval processes. AI agents can automate this entire process. This saves so much time and human effort, which could be utilized for more important banking work.

AI-powered agents can streamline the loan application process. From query of a loan, to document gathering, background checks, underwriting, decision making and disbursement of the loan. AI agents can also send real-time updates to the customers throughout the loan process.

AI agents play the role of intelligent financial advisors by analyzing customer profiles, transaction history, and real-time market data. With this, they offer the customer personalized investment recommendations, savings strategies, and risk-aware financial guidance that can help make informed financial decisions.

The AI agents monitor every transaction, detect anomalous behavior, and assess fraud risks in real time. Being continuously trained by evolving fraud patterns, they can proactively block suspicious activities and trigger alerts, minimizing false positives.

AI agents immediately automate reconciliations by matching various system transactions and highlighting discrepancies. They accelerate settlement processes by reducing manual effort and guarantee accuracy and punctuality in financial reporting across all bank operations.

Also Read - The New Era of Software: How AI Development Is Reshaping Applications

As the future of banking is ruled by AI agents, banks must transition from rule-based automation to an agentic AI ecosystem. Its ability of autonomous reasoning, planning, and execution can take care of the entire banking operations.

Agentic AI development companies utilize large language models (LLMs), reinforcement learning, and multi-agent orchestration to handle complex workflows with minimal human intervention.

Mobcoder.ai brings deep expertise in designing and deploying secure, scalable agentic AI solutions for banking and financial services. Our AI experts deploy AI for banking operations using advanced LLM frameworks, vector databases, and event-driven architectures.

As a leading AI development company, our solutions are designed for high availability, auditability, and scalability, helping banks build resilient, future-ready banking ecosystems fueled by autonomous AI agents.

AI Agents in banking can understand context, reason, plan, and execute multi-step tasks autonomously. Unlike chatbots performing simple tasks, AI agents can handle complex workflows such as KYC, Loan Processing, Fraud Detection, and Customer Interactions.

While chatbots respond to simple queries with pre-fed answers, AI agents act, make decisions on their own, and learn from new data fed into the applications. AI agents go way beyond mere conversation by automating processes and delivering on outcomes.

AI agents in banking improve repetitive and manual tasks, such as KYC/AML checks, transaction monitoring, reconciliation, and regulatory reporting. These will reduce errors, increase the speed of processing, and enable bank staff to be utilized for higher-value work.

Yes. AI agents help enable quicker responses, personalized financial advice, real-time updates regarding loans or accounts, and support from multiple touchpoints via real-time updates.

AI agents are designed with robust security, compliance, and audit controls. They can operate within regulatory frameworks and support data privacy, access controls, and transaction traceability.

Key use cases of AI agents in banking include customer onboarding, loan origination, fraud detection, financial advisory, transaction reconciliation, and regulatory compliance reporting.

AI agents monitor, in real time, the transactions that detect unusual patterns, learn from evolving fraud behaviors, and trigger alerts or preventive actions to reduce fraud and false positives.

Yes, AI agents can automatically manage compliance verification, monitor updates to regulations, report creation, and also ensure the adherence to KYC, AML, and other banking regulations.

Agentic AI is a form of AI that possesses the capability of independent reasoning and performance. This calls for banks to go beyond automation based on rules to intelligent systems that can be scaled up, adapted, and managed with efficiency in complex operations.

Banks should start by identifying high-impact processes, ensuring data readiness, and partnering with an experienced agentic AI development company like Mobcoder to design secure, scalable AI solutions.

Girijesh Kumar

February 18, 2026

10min

Marc Rothmeye

February 03, 2026

8min

Girijesh Kumar

January 27, 2026

9min